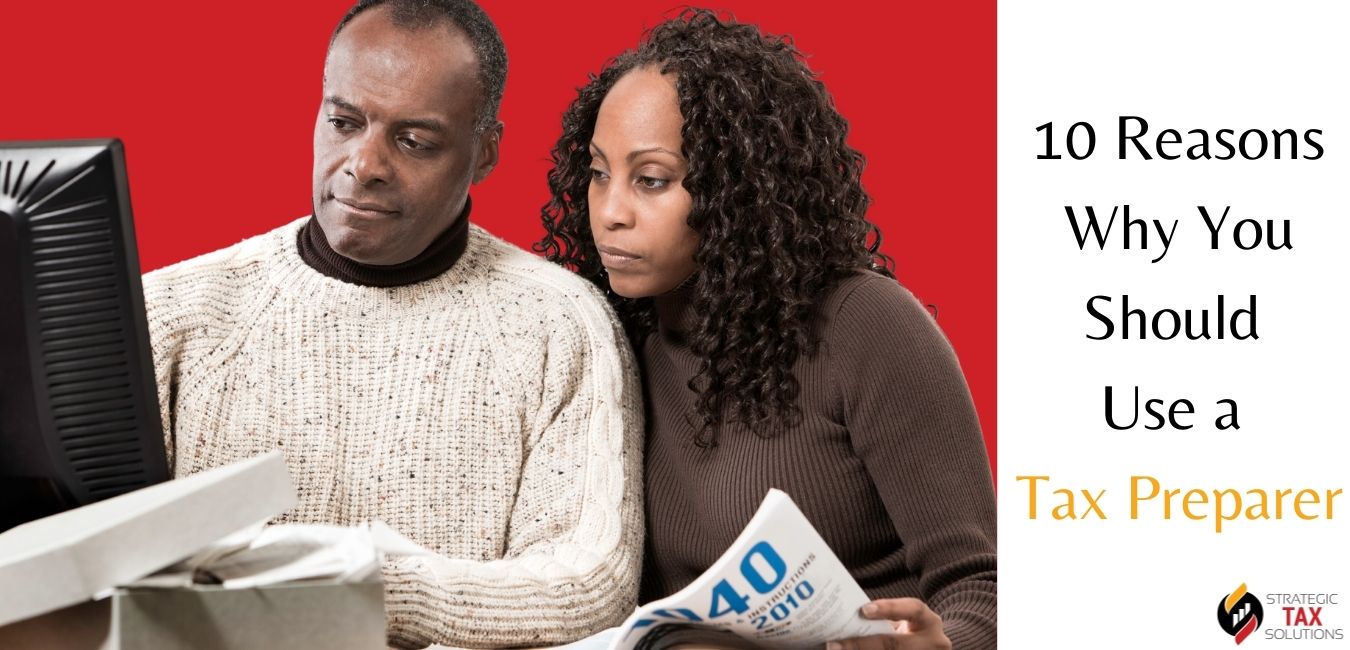

Using tax preparer services is the right thing for various reasons. Many people think that it is not wise for tax preparers as it will cost some money. In reality, a professional tax preparer can help you save so much apart from removing unnecessary burdens off your shoulder.

But, many people do not know how to take things further when choosing the right tax preparer. You have to take some time to research before working with one.

Here is a list of ten reasons why a working and earning person should use a tax preparer.

Use Tax Preparer Services to Save Money

One of the main reasons people avoid using a tax preparer is that it might cost them some money. But a tax preparer can help you save money over a period.

If a tax preparer finds a single tax credit or deduction, you will save so much money. The amount that you will save is a lot compared to the fees that you pay. Now, this is one of the key reasons why you must use a tax preparer.

Tax Code is Quite Complex

The tax code is quite complex and complicated. You will have to spend so many hours understanding the code. Why waste your time when you can rely on tax preparer services.

Saves Your Time

You might have to spend so much time on tax preparation. But, if you use a professional tax preparer, you will save time and effort. A tax preparer will do everything necessary for you, from filing the tax returns to finding the right deductions and tax credits.

On average, a person spends more than 20 hours preparing taxes. You can save this time when you use professional tax preparer services.

Remove the Stress

Things can be overwhelming when you are preparing taxes all by yourself. If you use a tax preparer, you can remove this stress from your head and focus on other crucial aspects of your life.

Mistakes Can Cost You a Lot

A small mistake on the income tax return can cost you a lot. For example, if you missed using a tax deduction, or getting an IRS letter can so much stress. A professional tax preparer will ensure that you do not make any mistakes in the first place.

Have Them Review Past Returns

A professional tax preparer will not only prepare the current year’s tax returns but, you can also have them review the last three years’ returns.

Utilize Tax Planning Services

If you want to save money when filing taxes, you should do tax planning. A professional tax preparer will ensure that you are working on saving money before the time to file taxes arrive.

Dealing With IRS

IRS can call you for an audit. If it does, you do not have to fear much when you use a professional tax preparer to submit the tax returns. They will provide the necessary assistance. They can easily tackle all the queries of the IRS during the audit.

Answer Your Questions

No matter what kind of questions you have, you can always have them clarified with the tax preparer. They will answer all sorts of questions that you have to understand the tax code and why they suggest you do certain things.

One Item Off From Your List

Free yourselves by using the tax preparer service. They will tackle all the things for you.

The best part of your blog is when you said that you can remove the stress of preparing taxes all by yourself when you hire a tax preparer. With this in mind, I will be sure to hire a professional who can help me out. My wedding day is fast approaching, and I want to focus all my energy and attention on my special day. Thanks for sharing this.

I like that you said that tax planning could help you to save money when filing taxes, and a tax preparer could help. This is something that I will share with my aunt who has been clueless about how she should prepare her tax documents. She also wants to find a way to save on her tax fees, especially that she is always out of the country. She would surely love to hire a tax advisor for help.