FIND THE RIGHT INSURANCE FOR YOU

Strategic Insurance Solutions is a Utah owned independent insurance agency. We are here to help you in all of your insurance needs. Whether small or large, we will work together to create the right insurance plan for your unique needs. We can help you prevail when the unexpected happens.

INSURANCE PRODUCTS

Select a product below to learn more & browse our many carriers

YOUR INSURANCE SPECIALISTS

JAKE MELLOR CFP®, MBA, MAcc

OWNER, INSURANCE AGENT

Mikaleen Mellor, RDH, PLCS

Personal Lines Coverage Specialist

LICENSED INSURANCE AGENT

BRENT STOCKDALE, CLCS

Commercial Lines Coverage Specialist

LICENSED INSURANCE AGENT

ROSS TAYLOR

Life, Health, Business, Home & Auto

Financial Literacy Teacher at Alpine School District

LICENSED INSURANCE AGENT

Jake was born in Price, Utah. His parents moved shortly after he was born. He grew up in Fayette, Utah. He graduated from Gunnison High School in 2003. He graduated from Snow College with an Associates degree in 2004. He then served a mission for The Church of Jesus Christ of Latter-Day Saints in Tampico, Mexico. He is fluent in English and Spanish. He graduated from SUU with a Bachelors degree in Finance in 2010 and with a Masters of Business Administration in 2011. He married Mikaleen Loveless Mellor in 2008. They have one daughter.

He worked in Southern Utah serving clients and gaining valuable experience while attending college. He returned to Price to start his own business and built an office in 2011.

Jake dedicated himself from 2009-2012 to gaining work experience, improving his skills, and continuing his education working towards becoming a CERTIFIED FINANCIAL PLANNER™. In September of 2012, Jake completed this process and is now a CFP®. His gained experiences allowing him to see the whole financial picture, not just one area of it. He is currently serving clients across the state of Utah.

Mikaleen has been working at Mellor Financial since October 2018. Mikaleen has 3 wonderful children and has been a dental hygienist since 2009. Mika is a PLCS- Personal Lines Coverage Specialist. Mika does home, auto, umbrella, and other forms of personal insurance. Mika specializes in professional liability insurance because of her 10+ years of background in he medical field. When it comes to other professionals need to protect their income and their ability to continue to practice in their chosen field, Mikaleen Mellor is who you need to call! Mika enjoys life and takes every opportunity to live every moment to the fullest.

Brent Stockdale has been in the business of sales and marketing for over 20 years. Several of those years he ran his own insurance business. He opened his first

business at the age of 16 and has been working hard his whole life either opening, running and growing his own companies or helping others grow and run theirs. His passion in life is training and education. Brent lives his life with the idea that everything can be great. Brent has found that most people need someone to take the time to explain insurance and why it is needed.

“It is usually the small things that people put to the side or down low on their to-do list that keep them from being protected and covered when problems happen.”

Brent loves to use his personal experience, business know-how, and knowledge to help other businesses and consumers to meet their insurance needs. He excels at educating clients and taking the time to put together custom plans to take care individual needs.

Brent moved to Carbon County in 2007, bringing his wife and four children to help take care of her parents. They have fallen in love with the area and cannot see being anywhere else.

“My mission in life is to leave a lasting impression on others through educating and serving others. I strive to increase their quality of life and ambition for progress. I will, with a firm determination, do the little things, be genuinely interested, and focus on the light!”

Ross Taylor joined the Mellor’s team in November of 2017. Ross has been an inspiration and driving force for everyone around him. Ross has a wide range of work and academic experience to draw from and does not shy away from hard work. From a good ol’ farm boy to a seasoned school teacher and experienced insurance agent, Ross doesn’t fail to impress.

WHAT OUR CLIENTS HAVE TO SAY

“My cell phone was stolen and when I told Jake my story he advised that our policy could cover the cost of my stolen phone. My husband went to the office and we both were so impressed how well the office staff helped us. They immediately initiated the process and within two weeks we received a check. My husband and I are forever grateful and very impressed with Jake’s ability to remember our policy, know the details of that policy and head us in the right direction.”

GERI GAMBER

LEADING MINDS. LATEST PUBLICATIONS.

Everything You Ought to Know About Business Insurance

By typing in the phrase, 'business insurance near me,' you can find many companies offering this product. But what [...]

Balancing Medicare and Work-Based Insurance

Almost 20% of Americans 65 and older are still working — the highest level since before Medicare was established [...]

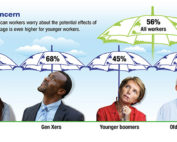

Do You Need Disability Insurance?

More than seven out of 10 working Americans believe that most people need disability insurance, yet only one out [...]

Offering Life Insurance as an Employee Benefit

Employee turnover has become a problem for many small businesses, primarily because it is often difficult and expensive to [...]