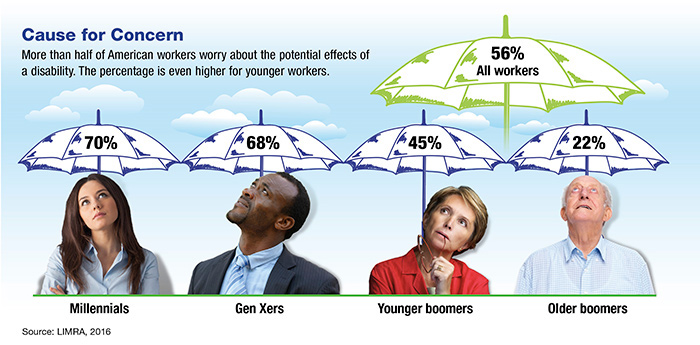

More than seven out of 10 working Americans believe that most people need disability insurance, yet only one out of three actually has disability insurance protection.1 This disconnect suggests the importance of assessing your own situation and determining whether you have appropriate financial backup in the event that you cannot work due to a disability or injury.

Preparing for an Emergency

Only 63% of U.S. households report having enough emergency savings to cover unexpected expenses such as a car repair or medical bill.2 But even if you do, consider whether you have enough resources to weather months or even years of lost income. Statistics indicate that the average worker has a 30% chance of a job loss due to a disability lasting 90 days or longer.3

Your ability to earn an income may be your most valuable asset. A 35-year-old worker who earns $60,000 a year could potentially lose $300,000 in wages during a five-year disability and $1.5 million or more if permanently disabled. Workers with higher salaries not only stand to lose much more but often have higher living expenses. How long could you and your family live comfortably without your income?

Portable Personal Coverage

Your employer may offer long-term disability coverage, but you could lose your subsidized coverage if you change jobs. Even if you remain covered through your job, group plans typically don’t replace as large a percentage of income as an individual plan could, and disability benefits from employer-paid plans are taxable if the premiums were paid by the employer.

An individual disability income policy could help replace a percentage of your income (up to the policy limits) if you’re unable to work as a result of an illness or injury. Depending on the policy, benefits may be paid for a specified number of years or until you reach retirement age. Some policies pay benefits if you cannot work in your current occupation; others might pay only if you cannot work in any type of job. If you pay the premiums yourself, disability benefits are usually free of income tax. And the policy will stay in force regardless of your employment situation as long as you pay the premiums.

Social Security might offer some disability protection, but the $1,171 average monthly benefit would not provide substantial income replacement for most workers. And qualifying for Social Security disability benefits can be a long and difficult process — about two out of three applications are initially denied.4

Even if you qualify for employer-based or Social Security disability benefits, having individual disability coverage in place could make the difference between being comfortable and living on the edge. You may be glad you had a backup plan to help provide for you and your family.

Leave A Comment