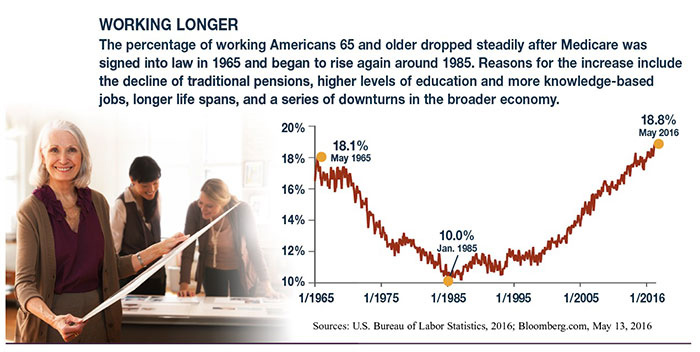

Almost 20% of Americans 65 and older are still working — the highest level since before Medicare was established in 1965. This amounts to almost 9 million workers who are eligible for Medicare, and the number is expected to grow as about 8,000 baby boomers turn 65 every day until 2030.1–2

Some employers may require employees or covered spouses to enroll in Medicare when they become eligible in order to retain their employer-sponsored health insurance. But many workers who are eligible for both types of coverage have to navigate an array of rules and other considerations regarding costs and coverage.

Primary vs. Secondary Insurance

If an employer has 20 or more employees, the employer coverage is primary and would pay first for covered expenses. Medicare is secondary and may pay for some expenses not covered by the employer coverage. If an employer has fewer than 20 employees, Medicare would be primary and the employer coverage would be secondary, which is why small businesses may require eligible employees or spouses to enroll in Medicare in order to keep their employer-sponsored coverage.

Part A Hospital Insurance and HSAs

Medicare Part A helps pay for inpatient hospital care as well as skilled nursing facility, hospice, and home health care. Because Medicare hospital insurance is free for most people, consider enrolling in Part A even if you have employer coverage. It could be helpful to have both types of insurance to fill any coverage gaps. However, if you have to pay for Part A, you may want to wait before enrolling.

If you have a high-deductible health plan through work, keep in mind that you cannot contribute to a health savings account (HSA) after you enroll in Medicare (A or B). The HSA is yours, even if you can no longer contribute to it, and you can use the tax-advantaged funds to pay Medicare premiums and other qualified medical expenses. So it might be helpful to build your HSA balance before enrolling in Medicare.

Whether you should opt out of premium-free Part A in order to contribute to an HSA depends on what you consider to be more valuable: secondary hospital insurance coverage or tax-advantaged contributions to pay future expenses. HSA funds can be withdrawn free of federal income tax and penalties provided the money is spent on qualified health-care expenses. HSA contributions and earnings may or may not be subject to state taxes.

Part B and Part D

Medicare Part B medical insurance, which helps pay for physician services and outpatient expenses, requires premium payments, so it would be wise to compare the costs and benefits of Medicare to your employer’s plan. If you’re satisfied with your employer coverage, you can generally wait to enroll in Part B. The same is true of Medicare Part D, which helps pay for prescription drug costs.

Enrollment Periods

Late-enrollment penalties may apply if you do not enroll in Medicare Part A and Part B when you are first eligible. If you are covered by employer-sponsored health insurance, these penalties generally do not apply as long as you enroll within the eight-month period that starts the month after the last day of employment or the employer-sponsored health coverage ends (whichever occurs first).

A late-enrollment penalty for Part D prescription drug coverage may apply if you go 63 or more consecutive days without having creditable prescription drug coverage. (Most employer plans are considered creditable.) Alternatively, during the two-month period after your workplace coverage ends, you could enroll in a Part C Medicare Advantage Plan that has prescription drug coverage.

Medicare rules are complex, and these are only guidelines. For more detailed information, visit medicare.gov.

Leave A Comment