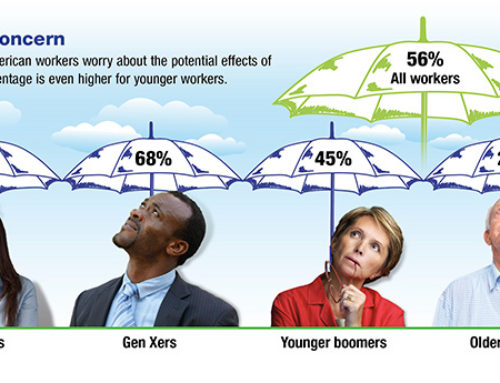

Employee turnover has become a problem for many small businesses, primarily because it is often difficult and expensive to replace experienced workers who decide to leave. In fact, 57% of companies report that employee retention is now a top concern.1

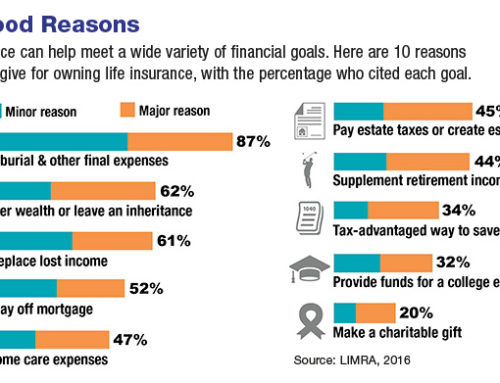

Making life insurance part of your employee benefit program could be a cost-effective way to recruit, reward, and retain valuable employees. You might provide a basic group term policy to all of your full-time employees and/or fund a bonus plan for key executives with cash-value life insurance.

Group Policies

Many employees have come to expect group life insurance as part of a standard benefit package. Group insurance is less expensive to purchase than individual insurance, and the death benefit is paid directly to the employee’s beneficiaries. Also, no medical exam may be required, depending on the number of covered employees.

With group policies, the premiums may be employer-paid, employee-paid (voluntary), or a combination of the two. If the company pays some or all of the premiums, it may be possible to deduct the policy costs as a business expense.

Bonus Plans

With an executive bonus plan, the business pays the life insurance premiums with bonuses that are tax deductible to the employer but taxable to the employees. The company determines the amount of each bonus and when to pay it, so the timing of the expense can be controlled. A bonus plan may also be designed with certain restrictions and vesting requirements that make the life insurance policy more valuable for an employee who remains with the company.

The employee owns the policy and also bears the responsibility for keeping it in force. He or she can borrow against, and sometimes withdraw from, the cash value if needed for emergencies, to pay college tuition, to help fund retirement, or for any purpose. If the policy is in force at the time of death, the employee’s named beneficiaries will receive the death benefit, minus any outstanding loans, free of income tax.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that the individuals for whom you are purchasing the policies are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. If a policy is surrendered prematurely, there may be surrender charges and income tax implications.

Leave A Comment