It’s no secret that the demographic profile of the United States is growing older at a rapid pace. While the U.S. population is projected to grow just 8% between 2015 and 2025, the number of older Americans ages 70 to 84 will skyrocket 50%.1

With roughly 75 million members, baby boomers (born between 1946 and 1964) make up the largest generation in U.S. history. As a group, boomers have longer life expectancies and had fewer children than previous generations.2

Now, after dominating the workforce for nearly 40 years, boomers are retiring at a rate of about 1.2 million a year, about three times more than a decade ago.3

Though the economy has continued to improve since the Great Recession, gross domestic product (GDP) growth has been weak compared with past recoveries. A number of economists now believe that demographic changes may be the primary reason.4

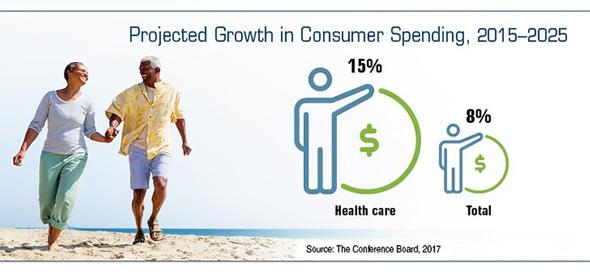

Spending Shifts

Retiring boomers are largely being replaced with younger, less experienced workers, which could reduce productivity. And with fewer young people joining the workforce, the consumer spending that fuels economic expansion and job creation could take a hit. When young people earn enough money to strike out on their own, it typically spurs additional spending — on places to live, furniture and appliances, vehicles, and other products and services that are needed to set up a new household.

On the other hand, when people retire, they typically reduce their spending and focus more on preserving their savings. Moreover, retirees’ spending habits are often different from when they were working. As a group, retirees tend to avoid taking on debt, have more equity built up in their homes, and may be able to downsize or move to places with lower living costs. More spending is devoted to covering health-care costs as people age.

If a larger, older population is spending less and the younger population is too small to drive up consumer spending, weaker overall demand for products and services could restrain GDP growth and inflation over the long term. Less borrowing by consumers and businesses could also put downward pressure on interest rates.

A New Normal?

The onslaught of retiring baby boomers has long been expected to threaten the viability of Social Security and Medicare, mainly because both are funded by payroll taxes on current workers. But this may not be the only challenge.

A 2016 working paper by Federal Reserve economists concluded that “demographic factors alone account for a 1.25 percentage point decline in the natural rate of real interest and real gross domestic product growth since 1980.” Demographic changes could remain a structural impediment to economic growth for years to come.5

Many economists acknowledge that U.S. population trends are a force to be reckoned with, but the potential impact is still up for debate. Some argue that labor shortages could drive up wages and spending relatively soon, followed by higher growth, inflation, and interest rates — until automated technologies start replacing larger numbers of costly human workers.6

Even if demographic forces continue to restrain growth, it might not spell doom for workforce productivity and the economy. Another baby boom would likely be a catalyst for consumer spending. Family-friendly policies such as paid maternity leave and day-care assistance could provide incentives for women with children to remain in the workforce. It’s also possible that a larger percentage of healthy older workers may delay retirement — a trend that is already developing — and continue to add their experience and expertise to the economy.7

Leave A Comment